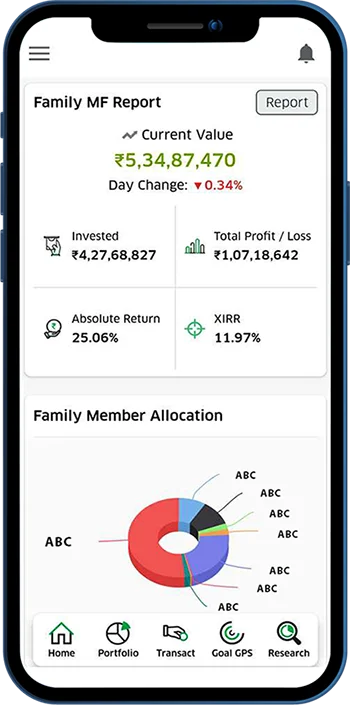

We made the investment reports very easy through Mutual fund software for distributors, all the key data you can view in a glance. We provide best financial management platform in India to advisors.

Shri V. Nallasami is a graduate in Mathematics from Madras University and holds a postgraduate degree in MBA with a specialization in International Business. He is also a Chartered Member of the Financial Planning Standards Board India, affiliated with FPSB Ltd., U.S.A., and has earned an LLB from Dr. Ram Manohar Lohia Law College, Bengaluru. Currently, he is a practicing lawyer with a deep understanding of finance and its impact on life. He provides guidance to business professionals on effectively managing money, overcoming financial stress, and optimizing cash flow to achieve a successful business career.

He specializes in areas such as Non-Performing Asset (NPA) management, addressing financial stress faced by business entities, and handling cases in various legal forums such as the Debt Recovery Tribunal (DRT), Debt Recovery Appellate Tribunal (DRAT), National Company Law Tribunal (NCLT), and National Company Law Appellate Tribunal (NCLAT). His core expertise includes offering customized solutions to business entities for maintaining cash flow, avoiding financial stress, and structuring One-Time Settlement (OTS) packages that balance the interests of both borrowers and lenders.

Learn More

Happy Clients trust us with their financial journey and a prosperous future.

Projects completed , showcasing our commitment to excellence and delivering successful outcomes.

Years of experience bringing expertise and trust to every financial journey.

Wealth management encompasses a comprehensive approach to growing and safeguarding assets.

Insurance offers financial protection against various risks, ensuring peace of mind for you and your family.

Professional management of portfolios to achieve investment goals tailored to individual preferences.

Alternative Investment Funds (AIFs) are pooled investment vehicles catering to sophisticated investors.

Bonds are debt instruments that offer regular interest payments and the return of principal upon maturity.

Health insurance provides financial protection against medical expenses, ensuring access to quality healthcare.

We made the investment reports very easy through Mutual fund software for distributors, all the key data you can view in a glance. We provide best financial management platform in India to advisors.

We offer a 100% paperless process of investment. It takes a few seconds to register a SIP or Purchase an ELSS.

Give purpose to your investments, you can map all your investments with the goal like child education, marriage or retirement.

Invest in well researched cherry-picked perfectly balanced portfolio.